Економічні науки/4. Інвестиційна

діяльність та фондові ринки

Polevaya

T.V., Kotelevskaya I.P.

Kharkiv State University of Food Technology and Trade,

Ukraine

The domestic stock market state

estimation with use stock exchange indices

Stock

exchange indices are effective tools of analysis and prognostication of prices

changes at the securities market. Their publication allows to be well-informed

to participants of stock market. Stock exchange indices value is the guideline

for making decisions by participants in the relation to the estimation of

securities portfolio management efficiency. It causes practical interest to the

integral estimation of securities market state and it confirms the actuality of

this topic.

The

research testifiers that works of domestic and foreign scientists are mostly

devoted to the stock market state investigation on the base of the analysis of

stock exchange indices evolution. Among these

works it’s possible to select works of Basowa I., Maslowa S., Mendrule O., Mirkin G., Opalow O.,

Yanukayn M. and so on. The noted economist attention mostly concentrates on the

problems of stock exchange securities trade intensity and indices of market

capitalization of stock platforms researching. Questions of adoption of stock

exchange indices as tools of domestic securities market estimation are still

actual.

We

generalized characteristic features and description of stock exchange indices

on the base of their role and value analysis in the market situation estimation

(table 1).

Table 1. Characteristic and special features of

stock exchange indices use

|

Characteristic features of

indices |

Description of the index |

Information user |

|

Index as indicator of the economy state |

The index must reflect long-term trends economy development

demonstrate the difference of levels development in different fields of the

industry. |

Organs of state regulation of

economy, representatives of business, mass media |

|

Index as instrument of analysis and prognostication of the securities

market state |

The index must reflect the current situation at the market and

characterize market fluctuations |

Professional participants of securities market, investor |

|

Index as base of price fluctuations hedging at the financial market |

The index are used for insurance from the prices risk |

Heads of the investment funds |

|

Index as indicator of securities portfolio and guideline at the

estimation management efficiency of it |

The index provides the possibility of comparison of certain securities

portfolio profitability with averaging volume investment portfolios that

allows to describe management quality |

Investor, professional participants of securities market |

Stock

exchange indices enter to the system of the economic monitoring of the national

economy state next to other economic indicators, that is why it is necessary to

consider their functions (fig. 1).

Fig. 1 – Functions of stock exchange indices

There

are some restrictions in use of stock exchange indices, namely:

1)

indices demonstrate just quantitative changes, but they don’t reflect

reasons of these changes;

2)

indices require the periodic corrections of components which are used

for their calculations;

3)

it is possible to manipulate by indices, their values can be increased

or reduced artificially [1]

The

price PFTS index is the main indicator of domestic securities market

development. This index is formed by the volume of issue and it is accessible

for the wide circle of investors. The «index basket» of PFTS consists of twenty

elements, which represent seven directions. They are fuel and energy system and

metallurgy, banking system, information and telecommunication sphere,

engineering and chemical industries [2].

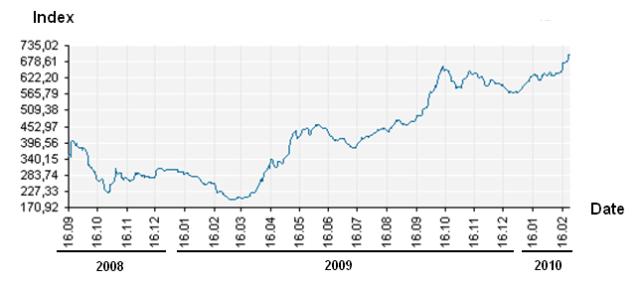

Beginning

from 1997 up to how maximum index of PFTS was measured 15.01.2008 – 1208,61.

Maximum volume of sales was recorded 13.11.2008 – 3,08 billion hrn [3]. The

graph of PFTS index dynamics from 16.09.2008 till 16.02.2010 is presented in

figure 2. Graph date testify that maximum value was recorded 16.10.2009 –

649,85.

Fig. 2 – PFTS index dynamics

The

value of PFTS index from 01.02.2009 till 01.02.2010 was increased 2.7 times

(table 2). Analysts explain such increase by speculative manipulations of

securities prices, especially stock of big companies [3].

Table 2. Domestic stock

exchange index dynamics

|

PFTS |

2009 |

2010 |

|||||||||||

|

February |

March |

April |

May |

June |

July |

August |

September |

October |

November |

December |

January |

February |

|

|

Average value |

241,87 |

207,82 |

301,81 |

412,66 |

432,03 |

401,28 |

446,76 |

487,62 |

613,34 |

620,67 |

591,48 |

611,85 |

660,56 |

Table

date testify that during 2009 – beginning 2010 the tendency of increase of

domestic PFTS index value was observed that is explained by the change of the

structure of demand and supply of securities of stock market and fluctuation of

stock prices.

Thus,

stock exchange indices play an important role in estimating complex market

processes and tendencies of financial sector development, that is why it is

expedient to implement them as a tool of analysis of the state of domestic

market securities in the future.

Reference literature:

1.

Басова, І. Цінні папери: ринок, операції, облік [Текст] / І. Басова, Н. Петрова. – Х. : Фактор, 2009. – 624 с.

2.

Маслова, С.О. Фінансовий ринок [Текст] / С.О. Маслова, О.А. Опалов - 4-е вид. – К. : Каравела,

2008. – 288 с.

3.

Статистична інформація щодо біржових індексів [Електронний ресурс]. – Режим

доступу: <http://expert-asset.com.ua/index.php?option=com_content&task=view&id=79&Itemid=122#>.