Åêîíîì³÷í³

íàóêè/2. Çîâí³øíüîåêîíîì³÷íà ä³ÿëüí³ñòü

Òàõòàðîâà Þ.Î., Øåðåìåò Ò.Ã.

Äîíåöüêèé íàö³îíàëüí³é

óí³âåðñèòåò åêîíîì³êè ³ òîðã³âë³

³ìåí³ Ìèõàéëà Òóãàí-Áàðàíîâñüêîãî

Foreign exchange market as one of the world

financial markets

Foreign exchange is

the act of trading different nation’s moneys. The greater part of the money

assets traded in foreign exchange markets are demand deposits in banks. A very

small part consists of coins and currency of the ordinary pocket variety.

Foreign exchange

transactions typically involve one party purchasing a quantity of one currency

in exchange for paying a quantity of anothers. The foreign exchange market is one of the largest and most liquid

financial markets in the world, and includes trading between large banks,

central banks, currency speculators, corporations, governments, and other

institutions.

The purpose for

such a market is to facilitate trade and investments. The need for a foreign

exchange market arises because of the presence of multifarious international

currencies such as US Dollars, Pound Sterling, etc, and the need for trading in

such currencies.

The foreign

exchange market is unique because of:

- its trading volumes;

- the extreme liquidity of the market;

- its geographical dispersion;

- its long trading hours: 24 hours a day

except on weekends (from 22:00 UTC on Sunday until 22:00 UTC Friday);

- the variety of factors that affect exchange

rates;

- the low margins of profit compared with

other markets of fixed income (but profits can be high due to very large

trading volumes);

- the use of leverage.

An exchange rate is

the price of one nation’s money in terms of another nation’s money. There are

two basic types of exchange rate, depending on the timing of the actual

exchange of moneys. the spot exchange rate is the price for ‘immediate’

exchange. For standard large trades in the market, immediate exchange for most

currencies means exchange or delivery in two working days after the exchange is

agreed, while it means one working day after the exchange is agreed for

exchanges between U.S. dollars, Canadian dollars, and Mexican pesos.

The forward

exchange rate is the price set now for an exchange that will take place

sometime in future. Forward exchange rates are prices that are agreed today for

exchanges of moneys that will occur at a specified time in the future, such as

30, 90, or 180 days from now.

The foreign

exchange market is not a single gathering place where traders shout buy and

sell orders at each other. Rather, banks and the traders who work at banks are

the center of the foreign exchange market. These banks and their traders use

computers and telephones to conduct foreign exchange trades with their

customers and also with each other.

The trading done

with customers is called the retail part of the market. Some of this is trading

with individuals in small amounts. Most of the retail part of the market

involves nonofficial companies, and other organizations that undertake large

trades as the customers of the banks that actively deal in the market. The

trading done between the banks active in the market is called the interbank

part of the market.

The banks active in

foreign exchange trading are located in different countries around the world,

so this is a 24-hour market. Main foreign exchange market turnover is presented

on the figure 1.

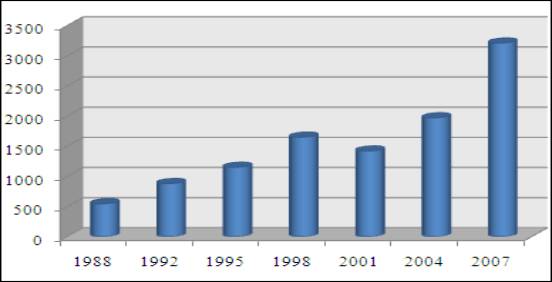

Figure 1 Main

foreign exchange market turnover, 1988-2007, billions of USD

According to the

figure 1 we can make a suggestion about constant growth of foreign exchange

market turnover during the examined period.

On working days,

foreign exchange trading is always occurring somewhere in the world. Although

banks throughout the world participate, half of foreign exchange trading

involves banks in two locations: London and New York.

Fluctuations in

exchange rates are usually caused by actual monetary flows as well as by

expectations of changes in monetary flows caused by changes in gross domestic

product (GDP) growth, inflation (purchasing power parity theory), interest

rates (interest rate parity, Domestic Fisher effect, International Fisher

effect), budget and trade deficits or surpluses, large cross-border M&A

deals and other macroeconomic conditions. Major news is released publicly,

often on scheduled dates, so many people have access to the same news at the

same time. However, the large banks have an important advantage; they can see

their customers' order flow.

To sum up, it is

important to mention that foreign exchange market is where currency trading takes place. Foreign exchange

transactions typically involve one party purchasing a quantity of one currency

in exchange for paying a quantity of another. This market includes trading between large

banks, central banks, currency speculators, corporations, governments, and

other institutions. The average daily volume in the global foreign exchange and

related markets is continuously growing.